- Key Takeaways

- What Makes OQtima Stand Out?

- 1. Platform Usability

- 2. Account Flexibility

- 3. Execution Speed

- 4. Asset Diversity

- 5. Support Quality

- My Trading Experience

- The Onboarding

- The First Trade

- The Withdrawal

- OQtima Fees and Costs

- Trading Fees

- Non-Trading Fees

- Transparency and Cost-Effectiveness

- Hidden Fees and Profitability

- Is OQtima Safe?

- Regulatory Oversight

- Fund Security

- Data Protection

- Available Trading Tools

- Charting Software

- Analytical Resources

- VPS Hosting

- Who Should Use OQtima?

- Conclusion

- Frequently Asked Questions

- What is OQtima and how does it work?

- Is OQtima a safe trading platform?

- What are the fees and costs for using OQtima?

- Who can use OQtima?

- What trading tools does OQtima offer?

- Can I access OQtima on mobile devices?

- How do I start trading on OQtima?

Key Takeaways

- OQtima is distinguished by its easy-to-use trading platform, state-of-the-art tools and competitive pricing and it’s ideal for novices and professional traders globally.

- With flexible account types, low minimum deposits, and multiple funding methods, the platform is accessible to a variety of trading requirements.

- Quick trade execution, a broad array of trading instruments and powerful market research tools empower users to capture global market opportunities and manage risk.

- Traders enjoy transparent fees, minimal non-trading costs and an effortless withdrawal process, facilitating a cost-efficient and enjoyable trading journey.

- OQtima puts safety first — with robust regulatory oversight, state-of-the-art data protection, and secure fund segregation — cultivating confidence and trust among users.

- With its attentive customer service and robust educational tools, oqtima review fosters a supportive space where traders thrive.

Oqtimastands out with its simple design and functionality such as live feeds, transparent kanban boards, and robust sharing capabilities. A lot of people enjoy the clean interface and straightforward actions to monitor progress. Teams across fields use Oqtima to keep work on-track and share updates — no hassle. Other reviews mention the tool’s fast configuration and how it works well for both large and small scale projects. In this post, see what real users say, top pros and cons, and if Oqtima suits your daily work or larger team objectives.

What Makes OQtima Stand Out?

Here’s what really separates OQtima from the pack: a combination of smart technology, flexible accounts, and a global Outlook. For traders looking at a platform that strikes a balance between pricing, usability, and support, OQtima combines several features for novices and experienced types alike.

- Seamlessly connected trading suite and sophisticated Trading Central’s research

- Ultra-low spreads from 0.0 pips, competitive crypto spreads ($13 BTCUSD)

- Fast, reliable order execution with minimal slippage

- Free VPS for high-volume traders and easy mobile access

- Eight base currencies supported, Easy onboarding in less than 3 minutes.

- Commission-free account option for fee-sensitive traders

- Multiple funding methods, including global bank transfers

- 24/7 responsive customer support and continuous platform improvements

1. Platform Usability

OQtima’s interface just plain feels slick and uncluttered, with intuitive menus and tabs that even beginners can navigate. It’s simple to locate what you need or make trades swiftly. Our mobile trading app allows you to monitor markets and trade from just about anywhere, so you won’t miss moves while out and about.

Demo accounts include complete platform access, allowing novices to familiarize themselves with the system without risking actual funds. OQtima comes with multiple customisation options – change chart layouts, set up alerts, and tweak the dashboard to suit your working style.

2. Account Flexibility

There’s a variety of account types, so whether you’re new or desire the precision of raw spreads and high leverage via an ECN+ account, there’s a match. Low minimum deposits attract more than just high rollers, more people sign up.

It’s simple and worldwide to fund. International bank orders, and more, mean you can get your cash in and out with little fuss.

3. Execution Speed

Speedy execution counts — particularly if you employ split-second trade strategies. OQtima’s tech prioritizes minimal lag and low slippage, essential for ensuring fairness and trust. The platform’s openness regarding how trades are filled provides reassurance.

Fast installs = you seize more market opportunities.

4. Asset Diversity

OQtima provides forex, stocks, crypto, CFDs, and an extensive selection of ETFs. This wide variety allows you to diversify risk or experiment with new approaches easily.

Build a blend that matches your objectives, with the ability to access world markets without managing multiple accounts.

5. Support Quality

Support is primed around the clock, which comes in handy if issues arise in the wee hours. You receive fast, useful responses that don’t waste your time.

OQtima has guides and learning tools, so you can continue to develop your skills. We listen to feedback, which is why support just keeps getting better.

My Trading Experience

My experience trading with OQtima has been smooth, well-directed and well-supported. It all, from logging in initially to cashing out, just felt straightforward and fair. OQtima has constructed an environment in which even rookie traders can get comfortable without stress, while sophisticated analytics help keep each trade educated and grounded.

The Onboarding

OQtima’s onboarding is notable for its straightforward steps and absence of obstacles. Each direction is straightforward and in plain English, and every screen is user-friendly. It was this that allowed me to transition from sign-up to live trading without feeling lost.

I appreciated the educational content—quick tutorials and videos took me through the fundamentals, from employing chart types like lines and bars to knowing how spreads function. For a visual person like me, these guides were a godsend.

It took just a few hours to verify my account. I submitted my paperwork and received approval the same day, so I was able to begin trading nearly immediately. The OQtima team was very responsive to my inquiries, making me feel welcomed even prior to my first trade.

The First Trade

Making that first trade was a lot less intimidating than I anticipated. The dashboard was slick, and every action obvious. I could locate what I required—market, order, or tool—without hunting.

Real-time data was a huge bonus. Prices, spreads and news updated without lag, so I was confident about when to trade. Before acting, I used the charts to verify trends and swings. Choices between candlesticks, bars, line charts helped me see the big picture.

With great support and an easy to use interface, I got comfortable quickly. Other new traders I spoke with mirrored these sentiments, stating that they felt supported and trusted the platform’s process.

The Withdrawal

Withdrawals were fast and hassle-free. I selected the option that worked best, be it card, bank or wallet, and the money arrived to me in less than two days. We trust it, no-lemon-steps, no-weird-every-time-it-is-weird.

Checklist for smooth withdrawal:

- Check account balance and withdrawal limits

- Pick preferred method

- Confirm identity if needed

- Track status in the dashboard

Other traders I met shared the same view: fast payments, no complaints, and helpful support at every step.

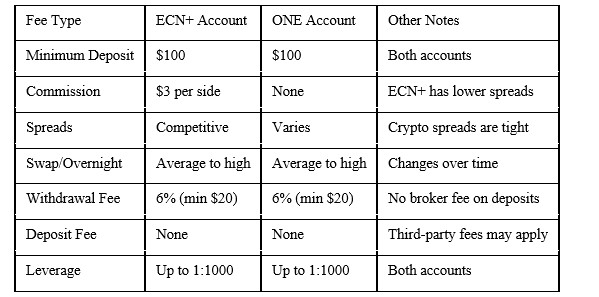

OQtima Fees and Costs

The platform lays out all fees in an easy fashion, allowing traders to plan more effectively. It sidesteps the sting of sneaky charges that can catch newbies off guard. Upfront fees so you can spend more time trading, not reading the fine print.

Trading Fees

OQtima is attractive to both novice and experienced traders due to its low fees. The ECN+ account, for instance, costs just $3.0 per side and is a trader favorite. It offers traders a chance for reduced trading fees and narrower spreads than the no-commission ONE account, which has wider spreads.

- Forex: Spreads start from 0.2 pips on ECN+, no commission on ONE

- Crypto: Competitive spreads, no extra commission on ONE

- Indices/Commodities: Spreads vary, check instrument list

- Stocks: Spreads depend on market, ECN+ often cheaper

ECN+ is for value seekers. Its transparent fee schedule helps you strategize trades and control expenses without unexpected shocks. That aids budgeting and keeps trading simple.

Non-Trading Fees

OQtima holds non-trading fees extremely low, helping you keep more of your gains. With no account maintenance or inactivity fees, you can walk away from trading, if you feel like it. That’s a comfort to anyone who likes to keep positions for the long-term or say take a vacation.

Funds deposits cost no broker fees, however you may observe fees from your payment provider. Withdrawals are 6% with a $20 minimum, so the bigger the withdrawal, the better the deal. All fees are upfront on the platform, so you know what to expect—no surprises.

These low and transparent non-trading fees make OQtima a convenient option for traders globally to steer clear of miscellaneous charges and stay uncluttered.

Transparency and Cost-Effectiveness

OQtima is one of the few companies that differentiates itself by being upfront with its fees. You don’t need to go looking for buried fees or convoluted regulations.

A lot of traders like that OQtima stacks up favorably against other brokers. Fees are transparent and straightforward to budget. Swap rates may be steeper than certain rivals, but explicit guidelines allow you to strategize for them.

Hidden Fees and Profitability

No hidden fees = what you see is what you pay. This helps traders understand their real expenses and retain more of their gains.

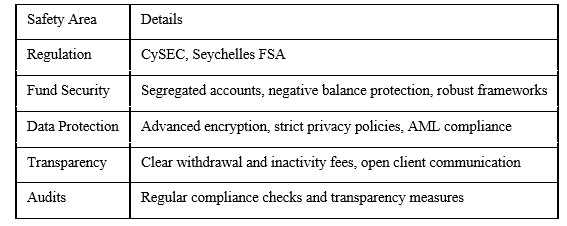

Is OQtima Safe?

OQtima is secure due to its combination of regulations, fund safety, and rigorous data measures. Its broker base in Cyprus and Seychelles requires it to adhere to stringent standards. Here’s a quick overview of OQtima’s main safety and regulatory features.

Regulatory Oversight

Being regulated by CySEC and Seychelles FSA gives OQtima real credibility, particularly for international traders keen to know their broker is monitored by recognized regulators. In other words, this implies OQtima can’t simply invent its own standards. They have to answer to regulators and satisfy standards. As a consequence, customers receive baseline safeguards, such as equitable service and transparent commerce. These policies aren’t just for show—OQtima undergoes regular audits, keeping their infrastructure and processes on point.

It builds confidence. Traders want to feel confident investing their money somewhere, and robust regulation assists with that. It’s true that some users experience hard verification hurdles, such as requests to send a video of themselves with their ID and wallet. This can be annoying, but it’s an indication the broker cares about compliance.

Fund Security

Client funds at OQtima aren’t held alongside the company’s. This is known as “segregation of accounts,” and it’s a recommended approach. So even if something happens to OQtima, your money will be secure. On top of that, they utilize negative balance protection. So, if markets move quick and your trade goes south, you won’t end up owing more than you invested.

Their balance sheets are constructed to keep it lean. Users have expressed concerns about withdrawal rules. For instance, it’s got a 6% early withdrawal fee, with a $20 minimum, and a $20 per month inactivity fee. These fees can accumulate for some, while others report speedy, assistive service from Orphan and co.

Data Protection

OQtima employs strong encryption to safeguard personal and financial data. Which means your information remains secure to outside invaders and hackers. With strict privacy protocols, ensuring that only essential personnel have access to your information. To battle money laundering, OQtima follows AML regulations. That’s why identity checks may seem rigorous but keep the trading room tidy.

It’s not only about regulation, it gives traders confidence. It means a lot to know your information is cared for properly.

Available Trading Tools

Oqtima’s trading platform combines some powerful tools for traders seeking versatility and agency. These are available in charting, research and high-performance services, with the goal of serving both novice and experienced traders.

Charting Software

Charting on oqtima is configured for the price action junkies. We provide 24 drawing tools, such as Fibonacci retracement and Elliott waves, that assist you in identifying price patterns and important levels. With 21 timeframes you can zoom in or out, from short-term scalps to longer trends, which keeps you in touch with price action in a manner that suits your style.

Customize – Quickly switch chart setups, select your indicators and rearrange based on your style of trading. Whether you desire basic moving averages or bespoke overlays, the platform enables your own build of what works for you. One-click trading is ready at hand. If you notice a setup you can get in quick which is huge if you’re trading short moves. The platform operates on MT4 and MT5, allowing you to access it on web, desktop, or mobile.

Analytical Resources

Market Buzz, Alpha Generation and the Trading Calendar are just a few of the tools traders research on oqtima. Market Buzz aggregates what’s going on across markets, so you’ll have a head start on what’s moving and why. Alpha Generation helps spotlight new opportunities as they arise, so you don’t miss out on setups.

Featured ideas allow you to peek at what analysts are viewing in the moment, and these ideas cover multiple markets, so you’re not limited to a single asset. The science is legit, but it’s primarily for the initiated—tutorials on these instruments are somewhat sparse. Even so, keeping up with news and trade ideas keeps you responsive.

VPS Hosting

For traders who require trades to propagate quickly and without latency, VPS hosting is included in oqtima’s platform. It reduces latency, which is important if you’re trading with expert advisors or depend on your strategy for speed. It executes even if your device is off, so your trading keeps going no matter what.

VPS is open to all account types, not only high tiers. That’s to say, anyone can benefit from faster trade execution and stable connections — handy when the markets are volatile.

Who Should Use OQtima?

OQtima appeals to both novice and experienced traders with its combination of tools and customizable features. Anyone entering trading to first can take solace in OQtima’s basic arrangement. With just two main account types, you won’t get lost in bewildering options. Opening an account is fast — less than three minutes. This appeals to individuals who want to begin trading quickly without all of the paperwork. For speedsters who like to get answers fast, OQtima’s 24/5 customer support is standing by via live chat, email, or phone.

Experienced traders want more than simplicity. OQtima is notable for high volume traders. If you trade over 5 lots a month and deposit over $100, you could receive complimentary VPS, which is useful for operating automated strategies. Volume traders can appreciate the platform’s high leverage and low trading costs. That’s particularly the case for tight spread seekers—OQtima’s crypto and share CFD spreads are relatively low compared to much of the competition.

Whether you’re a day trader or swing trader — and every style in between — there’s something for you here. OQtima allows for overnight positions, but it’s reassuring to see that the swap rates are moderate to high. Organized by day, if you’re holding trades for days or more, you’ll want to investigate how these rates impact your returns.

Crypto traders get a fair shot with OQtima with competitive spreads and 940+ tradable instruments. The breadth of markets allows you to seamlessly hop between stocks, forex, indices and commodities all within the platform. This broad offering plays out nicely for those who enjoy trading multiple markets or discovering new asset classes.

OQtima isn’t for everyone. Residents of the US, Iran and North Korea can’t use its services because of regulations. For the majority of world traders, those who appreciate a lean, speed and flexible trading environment, OQtima has his say.

Conclusion

OQtima establishes a calm stepping pace to follow for people who want no-nonsense instruments and simple directional actions in trading. My days with their platform were fluid and transparent — no runarounds or ambiguous jargon. OQtima is proud to keep costs low and flings all the numbers up front. I love how the tools enable me to track changes quickly and identify trends effortlessly. For traders who desire a sanctuary and pure-hearted assistance, OQtima fills the bill. Newcomers and veterans discover equal opportunity. Want to check it out to see if it’s your style? Try OQtima and see how it fits your ambitions. Trading may seem easy when you have the right tools.

Frequently Asked Questions

What is OQtima and how does it work?

OQtima online trading platform global financial market You can trade different assets, analyze market trends, and even manage your portfolios all from one interface.

Is OQtima a safe trading platform?

OQtima leverages encryption and security procedures to safeguard user data and funds. Trading is always risky. Never risk and trade safe online.

What are the fees and costs for using OQtima?

OQtima fees are very competitive. These can consist of spreads, commissions, and potential withdrawal or inactivity charges. See official site for up-to-date details.

Who can use OQtima?

OQtima works for novice and advanced traders alike. The platform offers easy-to-use tools and tutorials to accommodate all levels.

What trading tools does OQtima offer?

OQtima offers charting, indicators and real-time market data. These tools assist traders to make informed trading decisions and monitor their investments.

Can I access OQtima on mobile devices?

Yes, OQtima is mobile compatible. You can trade and manage your account using a mobile app or via web on smartphones and tablets.

How do I start trading on OQtima?

To begin, sign-up, verify, fund, and select your assets. OQtima leads new users through the process step-by-step.