Market Overview

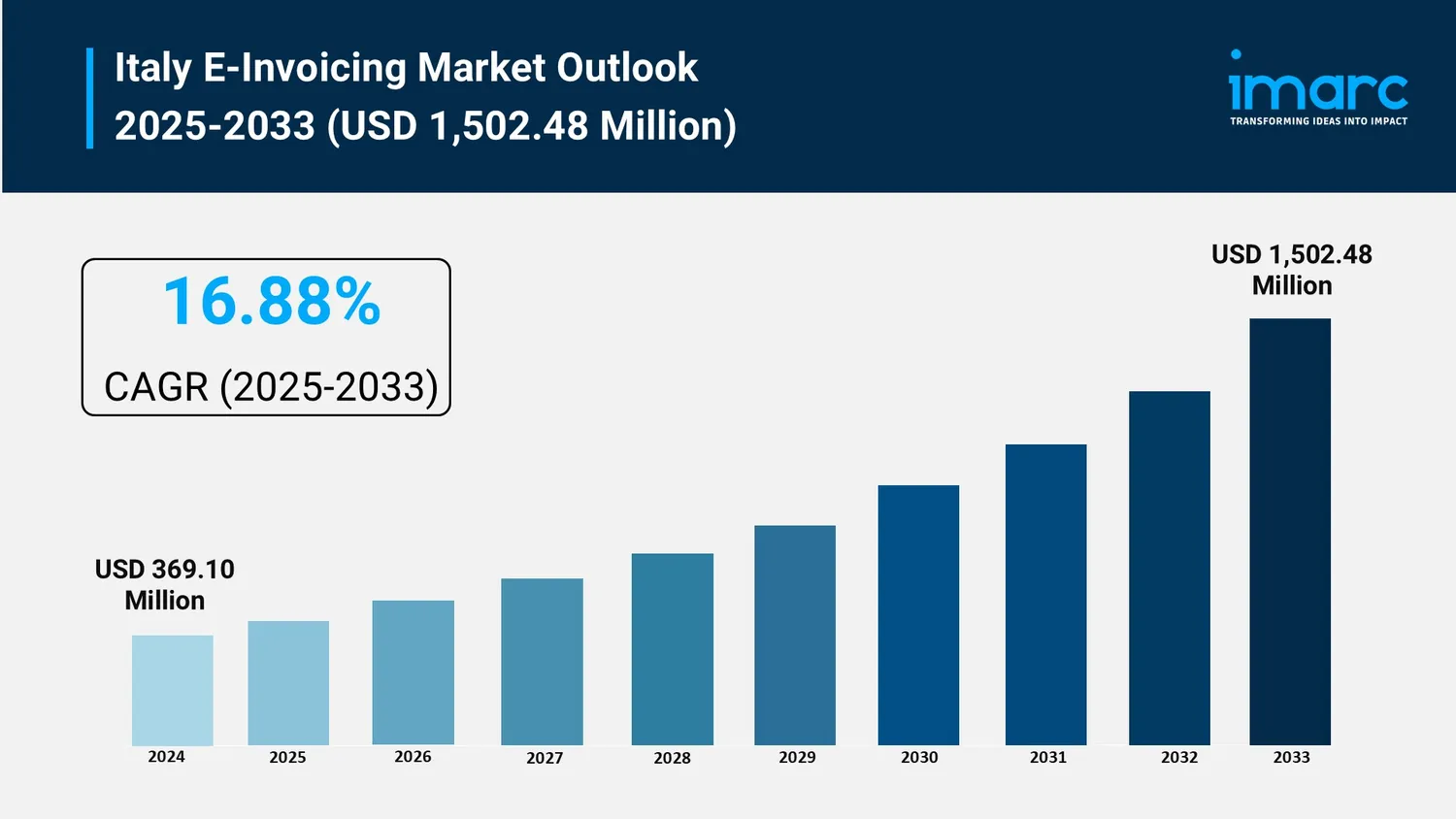

The Italy e-invoicing market size reached a size of USD 369.10 Million in 2024 and is expected to grow substantially to USD 1,502.48 Million by 2033. This growth is propelled by mandatory government regulations, enhanced compliance monitoring, and widespread digital transformation including cloud adoption. Increasing demand for operational efficiency across SMEs and large enterprises in domestic and cross-border transactions also fuels market expansion. This ensures stronger compliance with tax authorities and enhances real-time reporting benefits.

How AI is Reshaping the Future of Italy E Invoicing Market:

- AI-powered automation is accelerating invoice processing, reducing manual errors, and increasing operational efficiency across SMEs and large enterprises.

- Government mandates and AI-enabled compliance tools enable real-time monitoring and enforcement of tax regulations, significantly reducing tax evasion.

- AI-driven integration with cloud-based accounting platforms streamlines invoicing workflows for mid-sized businesses, helping them meet regional compliance requirements more effectively.

- Multinational corporations leverage AI to harmonize invoicing frameworks across European markets, standardizing workflows and simplifying audit readiness.

- AI-enhanced e-invoicing modules embedded in ERPs facilitate faster invoice clearance and digital signatures compliant with diverse tax authority rules.

- AI analytics provide insights for ongoing process optimization and risk assessment, enabling companies to adapt swiftly to regulatory updates such as Italy's Revenue Agency's e-invoicing version updates.

Grab a sample PDF of this report: https://www.imarcgroup.com/italy-e-invoicing-market/requestsample

Market Growth Factors

The Italy e-invoicing market growth is significantly driven by mandatory government regulations aiming to reduce tax evasion and improve compliance. The introduction and enforcement of structured B2G and B2B e-invoicing formats, alongside real-time reporting mandates, have compelled numerous SMEs and large enterprises to adopt digital invoicing solutions quickly. These regulations are reinforced by regional authorities tightening VAT enforcement, underlining the importance of digitizing invoice management. This government focus has turned previous regulatory burdens into operational upgrades and broader finance automation, intensifying market demand and adoption rates.

Another notable growth factor is the digital transformation of Italian businesses, particularly among mid-sized enterprises. Over the past years, these enterprises, historically slower in adopting digital invoicing due to budget and software legacy constraints, have been rapidly integrating e-invoicing directly into ERP and cloud-based accounting platforms. Local software vendors have introduced affordable subscription-based models tailored for regional compliance, enabling smaller companies to transition digitally without significant infrastructure investments. This shift is catalyzing a broader digitization wave within Italy’s financial operations, positioning e-invoicing as a stepping stone to comprehensive automation.

Growth is also driven by multinational companies operating within Italy and across Europe. Italy was among the first EU nations to mandate standardized e-invoicing formats, setting a regional benchmark. Multinationals now leverage this to unify invoicing processes across their European subsidiaries, integrating digital signatures, invoice clearance systems, and unified reporting tools that meet varied tax authority requirements. This harmonization effort is reducing processing time and improving audit readiness across jurisdictions, turning compliance into an enabling factor for finance transformation and cross-border efficiency gains.

Market Segmentation

Channel:

- B2B

- B2C

- Others

Deployment Type:

- Cloud-based

- On-premises

Application:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

Region:

- Northwest

- Northeast

- Central

- South

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Development & News

- February 2025: Italy's Revenue Agency updated its e-invoicing (FatturaPA) specifications to version 1.9 effective April 1, 2025. Updates include a new document type “TD29” for omitted or irregular invoices, changes to “TD20”, a new tax regime code “RF20” aligned with EU Directive 2020/285, and revised fuel sales and error codes, enhancing compliance and clarity in invoicing.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302